Heyy!

I know I know, who knew this blog thing would be so hard to maintain! I look up and boom there goes 2 months lol. But here I am... with a lot of excitement

I'm going to update my positions for the CME and QQQ. I'll tell you about facebook in the near future.

CME Group Inc - WINNER!

The CME has been the winner of the week! I had 2 strikes prices with a total of 5 Contracts but after today I still have the 2 strike prices but 2 contracts.

On 2/12/13 I purchased 3 CME Jun13 60 Calls when the stock was at 57.09. CME is the Chicago Mercantile Exchange where a lot of commodity and financial instruments are traded.

Why did I choose CME?

One major component that stuck out about the CME is that they profit from every contract that goes through their exchange, regardless if the market is bullish or bearish. If the economy continues to pick up the CME will benefit from hedging. if worries of the sequester come into play the CME benefits from liquidations of equities and the purchasing of fixed income. Last but not least the calls were extremely inexpensive.

After the first purchase I added to position and on 2/19/13 I purchased 2 CMEJun13 62.5 Calls when the stock was trading at 58.95.

On 2/27/13 I sold 2 CME Jun13 60 Calls trading at 59.78.

This article confirmed my hypothesis and there was even more growth: CME Contract Volume up 7%

Today (3/6/2013) I sold 1 CME Jun13 52.50 Call trading at 61.97.

I sold them because I wanted to take some money in, increase buying power and realize a gain. If the price goes lower I can buy them cheaper, if they keep rallying I'll hang on to the 2 contracts I have. You wanna hope for the best but plan for the worst... the stock could always go back down. Through these trades I realized a $332.46 gain.

QQQ Powershares Trust Series - loser

On 2/12/2013 I purchased 2 QQQ Apr13 68 Calls trading at $67.95. QQQ Powershares are an ETF of the NASDAQ. I used an ETF because it gave me the ability to trade an index.

- ETF- Exchange Traded Fund: A security that tracks an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange. ETFs experience price changes throughout the day as they are bought and sold. ETF SOURCE

- ETFs are also useful when getting your feet wet when it comes to commodities because like indexes the commodities are converted to ETFs to be traded like stocks.

Why did I choose QQQ?

There were two main factors that lead to the decision.

1. Stocks in the NASDAQ are tech companies, I see a huge boom in tech because investors are looking for growth companies which are most common within the technology sector.

2. A lot of non bulge bracket investors were keeping their money out of the market due to various political issues but Q1 earnings increased confidence to get back in the game and traditionally the first place they look is technology.

So all signs were pointing to a jump in the NASDAQ, we saw the S & P and the DOW reach highs and figured it was their turn.

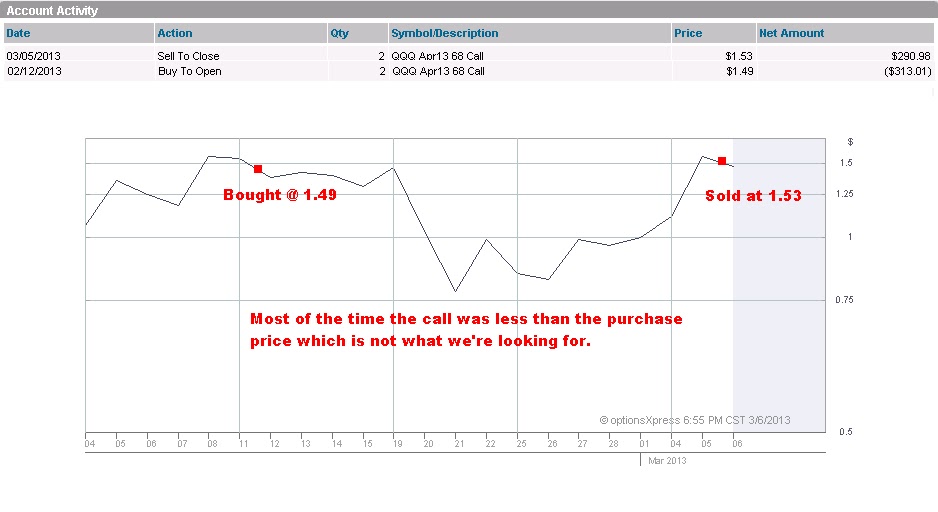

On 3/5/13 I sold 2 QQQ Apr13 68 Calls trading at 68.57

I attached a graph/table to show the beginning and end of the QQQ, the price was in the red for a majority of the time. It was up 4 cents yesterday and I decided to sell it. I like the index but I wanted to liquidate to lay off some risk, Apple's weakness is making it tough for QQQ to rally, especially by my expiration. After it was all said and done I lost about $22.03, which was mostly commission but you have to pay to play =)

That's all for now!

Also as a side note. For the more seasoned market aware folks reading, I won't be posting a lot of spreads/technical analysis on my blog. A lot of the technical mumbo jumbo confuses the everyday curious reader. Plus I can't give away all my secrets =)

Best,

Brit

I forgot! follow my twitter for up to date info or to ask me questions! I enjoy questions!

@TheBritReport